Open banking is expected to introduce new competition in the financial services industry and open the door to significant growth and innovative among FinTechs. Despite concerns about cybersecurity and data security, open banking is moving forward in the United States and Canada. Both the United States and Canada have announced frameworks for the implementation of open banking in the near future; however, their approaches differ in significant ways. However; a critical component of both open banking approaches is open APIs, which financial institutions use to securely share customer data with authorized third-party providers.

Open Banking in the United States: Open API-driven

The United States is largely pursuing a market-driven approach to open banking, in contrast to other countries, which have relied on government regulations to force an open banking system. To accelerate the open banking transition, a key player in the US’ open banking future, the Consumer Financial Protection Bureau (CFPB) recently proposed a major Personal Financial Data Rights rule. This rule would empower consumers to control their financial data and facilitate secure data sharing via open APIs. By ensuring standardized data access methods, open APIs are proposed to be the backbone for the US open banking framework.

The CFPB’s proposed approach has not been finalized; however, it has already received criticism for the lack of oversight and its singular focus on open APIs rather than building an entire open banking ecosystem. Despite these criticisms, the CFPB’s approach may have three significant benefits:

- Clarity for financial institutions on the scope of open banking, which allows them focus on the development of open API for secure data sharing

- It may present reduced compliance burden and costs for financial institutions compared with other approaches

- The largely market and consumer-driven approach may be less disruptive than adapting to broad-reaching government regulations

Opening Banking in Canada: Federal Government Framework

In April 2024, the Government of Canada announced “Canada’s Consumer-Driven Banking Framework” as part of Budget 2024. This framework provides the long-awaited implementation pathway for open banking in Canada. The federal government has been working on an open banking framework since 2018, and this announcement marks the most concrete step toward an open banking future in Canada. According to the Budget, the full open banking framework will be implemented in Canada by Fall 2024. Open banking in Canada will be overseen and regulated by the federal government, instead of an industry group of financial institutions. As a result, financial institutions in Canada should prepare to comply with a robust open banking regulatory framework.

This framework is the first tangible step toward a true consumer-driven banking system in Canada; however, true open banking will likely take several years to be implemented. Despite this, we are advising our Canadian financial institution clients to start building the infrastructure necessary to comply with open banking now.

What are Open Banking APIs?

Open banking APIs will be critical for adherence in both the United States and Canada. But what are open banking APIs?

Open banking APIs (Application Programming Interfaces) are standardized interfaces that allow third-party developers to build applications and services around financial institutions. Banks that embrace open banking protocols can grant permissioned access to customer financial data, enabling the development of a rich ecosystem of FinTech solutions.

Benefits of Open Banking APIs for your bank or credit union

- Enhanced Customer Experience: Open banking APIs pave the way for personalized financial services, tailored to the specific needs of individual customers. This leads to improved customer satisfaction and loyalty.

- Accelerated Innovation: By collaborating with FinTechs, financial institutions can rapidly introduce new products and services to market, keeping pace with ever-changing consumer demands.

- Potential Increased Revenue Streams: Open banking may create new revenue generation opportunities for financial institutions, depending on how the regulations are finalized.

- Improved Operational Efficiency: Open banking streamlines processes and reduces operational costs by automating data exchange and integrating disparate systems.

Securely developing, implementing, and managing Open Banking APIs

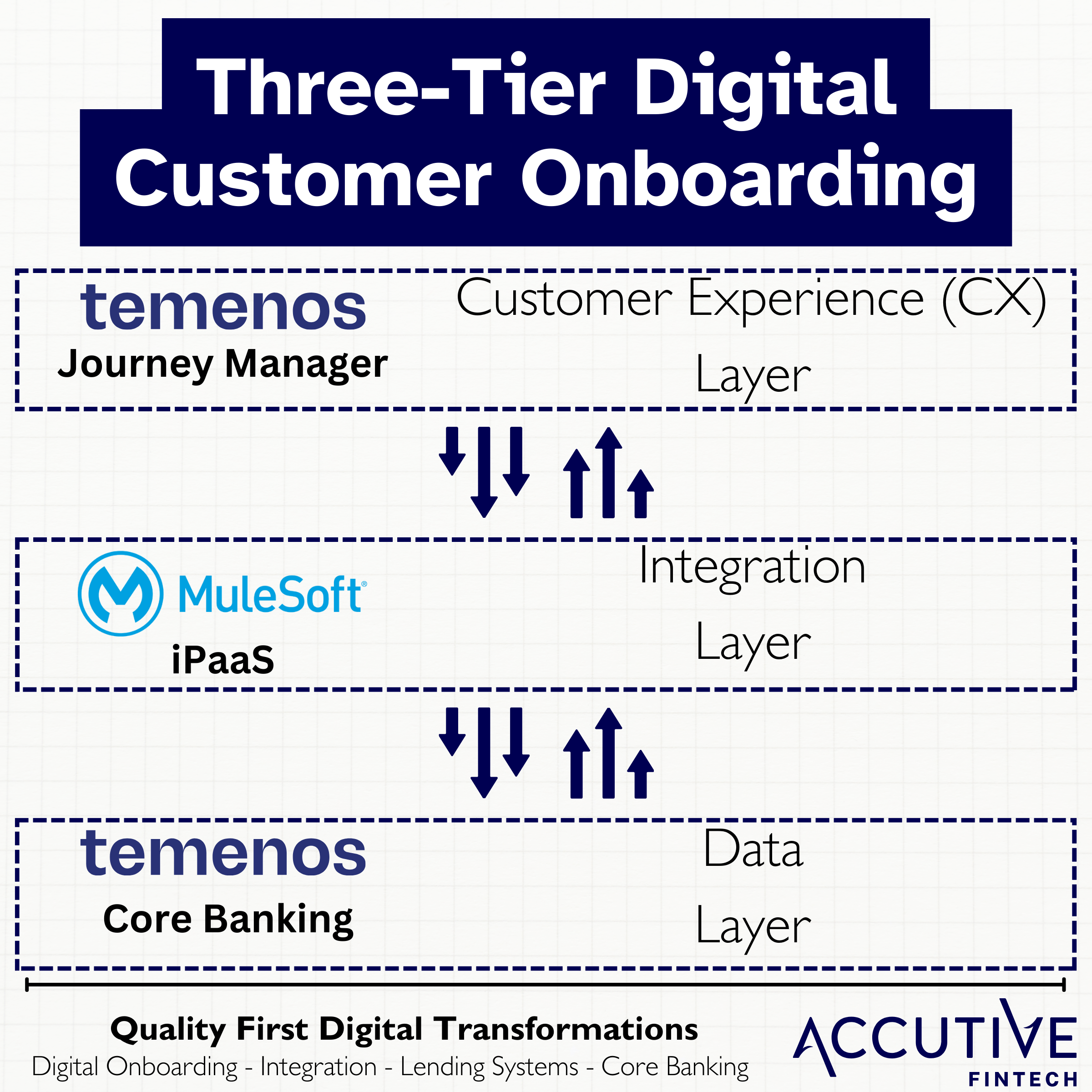

The success of open banking will hinge on secure, scalable, and well-governed open banking APIs. Given the increased number of APIs that will be ushered in by open banking, implementing an Integration Platform as a Service (iPaaS) solution is more critical than ever. Manually developing APIs for all relevant applications and performing the necessary integrations will be time consuming and risky.

Which iPaaS Solution is best for Open Banking?

Among the numerous iPaaS options on the market, Salesforce’s MuleSoft Anypoint Platform stands out as the ideal solution for open banking due to its API-driven approach that is augmented by robust API security, management, and governance capabilities.

Here are a few reasons why Accutive FinTech finds that MuleSoft’s Anypoint Platform excels the preferred iPaaS solution for open banking transformations:

- API-Led Connectivity: MuleSoft’s core strength lies in its API-led approach, simplifying the creation, management, and secure exposure of banking APIs.

- Rapid Integration: Pre-built connectors and a user-friendly interface dramatically accelerate the integration of legacy banking systems with modern fintech applications and third-party services.

- Scalability and Flexibility: MuleSoft’s architecture is designed to handle the increasing data volumes and complex integrations associated with open banking, providing a future-proof solution.

- Security and Governance: MuleSoft offers robust security features and fine-grained access controls, crucial for protecting sensitive financial data in compliance with open banking regulations.

With MuleSoft, you can securely develop, implement, and manage your open banking APIs in one platform.

Open Banking API Development

- API Design: MuleSoft’s Anypoint Design Center facilitates the collaborative design of RESTful APIs aligned with open banking standards (e.g., FDX in the US, or those that emerge from Canada’s framework). This involves defining API endpoints, data structures, and security mechanisms.

- API Development: MuleSoft’s Anypoint Studio offers a drag-and-drop interface and pre-built connectors for rapidly building API implementations. Developers can map data, implement business logic, and connect to backend systems like core banking platforms.

- Robust Testing: Anypoint Studio includes tools for unit testing and simulating API responses, enabling developers to catch errors and ensure API functionality before deployment.

Implementing Open Banking APIs

- API Deployment: MuleSoft supports flexible deployment options for open banking APIs. These can be deployed on-premises, in the cloud, or in a hybrid environment, depending on regulatory guidelines and the financial institution’s preferences.

- Security Configuration: MuleSoft’s API Manager allows for the implementation of API policies, such as rate limiting, OAuth-based authentication, and threat protection to safeguard sensitive financial data.

- API Gateway: MuleSoft’s API Gateway acts as a central point of control for managing access to open banking APIs. It handles authentication, authorization, traffic management, and versioning of APIs.

Managing Open Banking APIs

- API Monitoring: MuleSoft’s Anypoint Monitoring provides dashboards and analytics on API usage, performance, and errors. This helps identify bottlenecks, assess API health, and troubleshoot issues.

- API Versioning: As open banking standards evolve or new features are introduced, MuleSoft allows for the smooth versioning of APIs. This ensures backwards compatibility and seamless updates for consumer applications.

- API Documentation: Anypoint Exchange acts as a developer portal, providing comprehensive API documentation. This facilitates onboarding for third-party fintech developers, fostering innovation.

- API Governance: MuleSoft’s tools enable the establishment of governance processes around API development, deployment, access control, and lifecycle management. This ensures consistency, security, and compliance with the open banking regulatory framework.

Key Considerations for Open Banking API Development with MuleSoft

Accutive FinTech works with our clients to ensure that iPaaS and integration frameworks align with our API Integration Best Practices for the Financial Services industry and your regulatory compliance needs. Additionally, we work to extract the maximum value from your MuleSoft investment by helping our clients leverage features such as data transformation and consent management.

- API Compliance: Ensure API designs and implementations comply with relevant data protection regulations and open banking standards.

- Data Transformation: Leverage MuleSoft’s mapping and transformation capabilities to convert data into standardized formats for seamless exchange between systems.

- Consent Management: Implement robust consent management mechanisms in line with open banking regulations, empowering customers to control access to their financial data.

How to Prepare for Open Banking

The transition to an open banking world can seem daunting for financial institutions. With the right technologies in place, your financial institution can realize benefits from open banking. Although a number of technical changes may be needed to adapt to open banking, implementing an iPaaS platform with API creation and management functionalities may be the most important. Whether your financial institution is in the United States or Canada, Accutive FinTech’s experts will assess your integration strategy, API assets, and provide a roadmap for your open banking future. Get started today on the path to open banking with a complimentary assessment.