Escaping the paradigm of late, over-budget projects

Unfortunately, on time, on budget IT projects are often elusive. In the rapidly evolving digital banking landscape, there has never been a greater need to compress time to market. At the same time, quality is paramount.

The Project Management Triangle outlines the constraints around any project, including FinTech projects, and states that project quality is impacted by the budget, scope, and schedule. In order to preserve quality you must trade between these triple constraints. In many cases, there is no extra budget, the deadline is firm, and the scope cannot be reduced without major consequences.

At Accutive, we understand that when it comes to the financial services industry – glitches, bugs, and other issues are not an option. Compliance and security are critical for banks and credit unions, and client/member relationships are build on a foundation of trust.

This is where the Accutive Quality First Approach comes in. By putting quality at the center of our projects – we establish a foundation that leads to higher-quality results, while simultaneously increasing the odds of on time, on budget delivery.

Three Foundational Pillars to Quality

Accutive’s Quality-First Approach is built on three foundational pillars:

1. Low Developer to QA Ratio

2. Early and Detailed Requirements Analysis

3. Zero Defect Mentality

Low Dev to QA Ratio

Accutive resources our projects with more Quality Assurance (QA) experts than you may be used to. This approach enables:

- Enhanced + early testing

- Rapid issue identification + remediation

- Improved software quality

In the medium to long term, investing in QA resources upfront provides significant cost savings for you. Additionally, it gives you greater confidence in your releases, and assurance that you remain in compliance.

Upfront Requirements Analysis

At Accutive, we always ask upfront: “is the requirement ready for development?”. A rigorous discovery process is the bedrock of our approach. This enables accurate estimates (budget and schedule) and prevents misalignment. Additionally, failing to understand the scope or specifics of a requirement is a significant cause of defects and poor quality.

Upfront requirements analysis helps ensure clear, consistent understanding and minimize requirement changes.

Zero Defect Mentality

Zero defects is the ideal that every project should work toward. It may not necessarily be achievable in most projects, but the mindset of defect minimization has an immediate effect on quality.

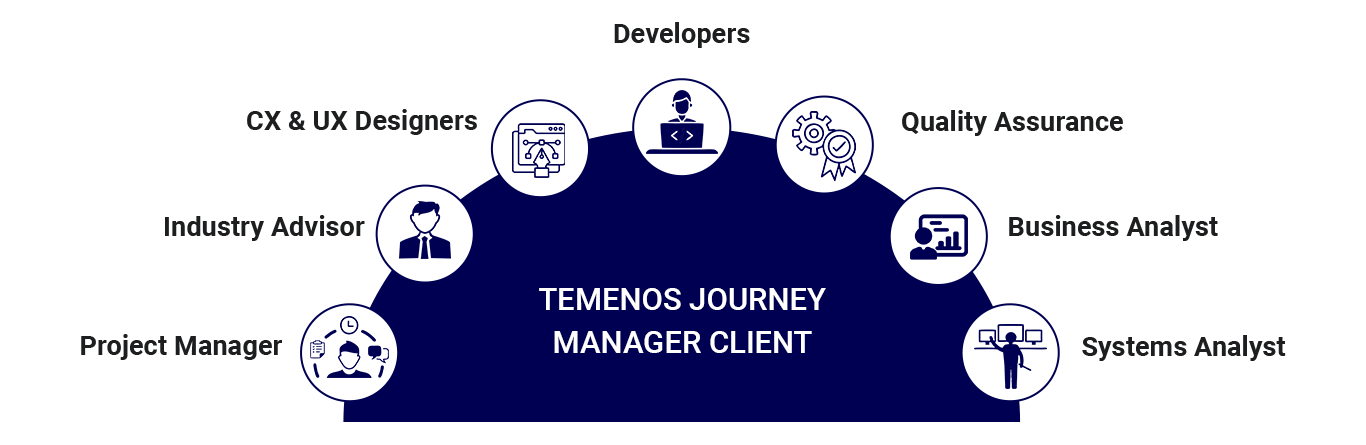

With our zero defect mentality, Accutive begins each project with the goal of defect-free delivery. Through continuous improvement we are getting close: our recent Capitalstream LOS integration project produced only a single defect and our recent Temenos Journey Manager projects have had defect rates ranging from 1.3 to 2.7%.