Introduction

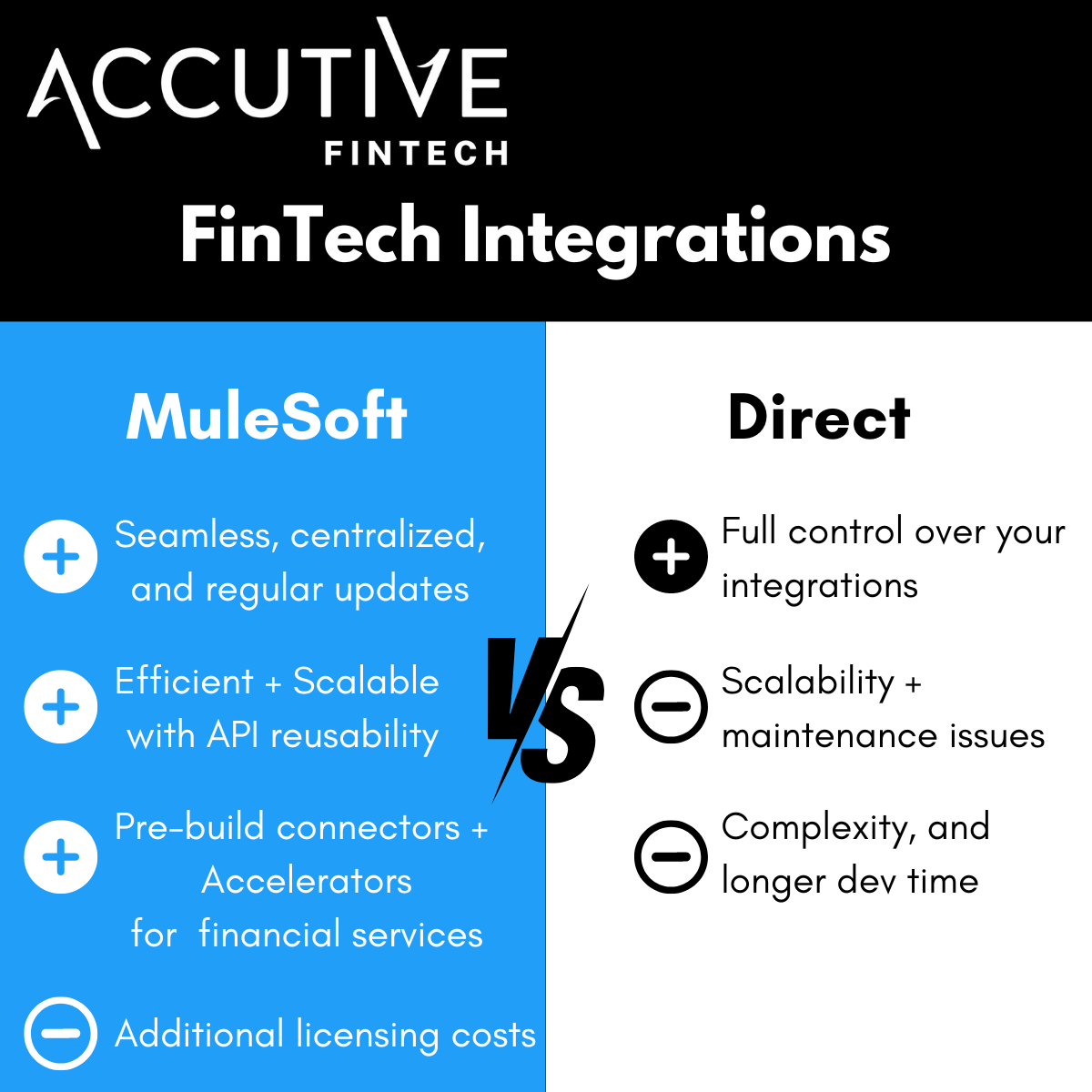

In the fast-evolving financial services sector, where banks and credit unions are constantly challenged to stay ahead of technological advancements, efficient system integrations play a pivotal role. For over a decade, Accutive FinTech has specialized in providing cutting-edge integration solutions that cater specifically to the unique needs of financial institutions. In this post, we compare Direct Integrations with MuleSoft Integrations, highlighting why MuleSoft is increasingly the go-to choice for the financial services industry.

The Traditional Approach: Direct Integrations for Financial Services

Direct Integration involves creating specific point-to-point connections between financial systems or applications.

Direct Integration considerations for your financial institution:

- The main advantage of direct integrations is that they can be highly tailored for your specific needs when you have a limited number of systems, without the licensing costs associated with MuleSoft.

- Limitations:

- Complexity in Scaling: In the dynamic financial sector, expanding or modifying these integrations can be complex and resource-intensive.

- Maintenance Challenges: With the fast-paced evolution in financial technologies, maintaining these bespoke integrations can be demanding. Accutive’s integration experts can mitigate these maintenance issues through effective API design and the use of our Integration Hub.

MuleSoft for your Financial Institution

MuleSoft is an iPaaS (Integration Platform as a Service) that facilitates seamless connectivity between all of your applications, data, and devices both in the cloud and on-premises. Accutive FinTech’s integration expert also leverage financial services-specific features to accelerate your deployment of new APIs.

Key Advantages of MuleSoft for your bank and credit union:

- Agile Integration: Enables banks and credit unions to quickly adapt to new financial regulations and evolving customer needs.

- Scalability and Flexibility: Effortlessly scales to accommodate growth, new technologies, or changes in the financial landscape.

- Comprehensive Connectivity: Offers robust connections between diverse financial systems, payment gateways, and customer-facing applications.

In the financial sector, where integration needs are complex and ever-changing, we typically recommend MuleSoft’s adaptable and scalable nature as a superior choice over direct integrations for banks and credit unions.

Why choose MuleSoft for Financial Services experts?

There are many MuleSoft consulting partners to choose from. How do you find the right partner for your FI? At Accutive FinTech, we specialize in customizing MuleSoft integrations to address the intricate needs of your financial institutions. We apply our decades of experience performing integrations specifically for the financial services sector to tailor each project to suit your technology stack. Our MuleSoft team exclusively serves financial services industry clients. As financial services experts, we know the importance of regulatory compliance and security, and design and develop your MuleSoft Anypoint platform with these factors top of mind.