Case Study: Minimizing Defects for Temenos Journey Manager Implementations

A large regional bank tasked Accutive FinTech with implementing Temenos Journey Manager to automate and enhance their customer onboarding experience as part of their digital banking transformation.

The client’s legacy onboarding process for both personal and small business clients required significant manual data entry and several days of review for approval and account opening. After a review process, the large regional bank opted for Temenos’ Journey Manager solution, a best in class digital account opening and onboarding solution.

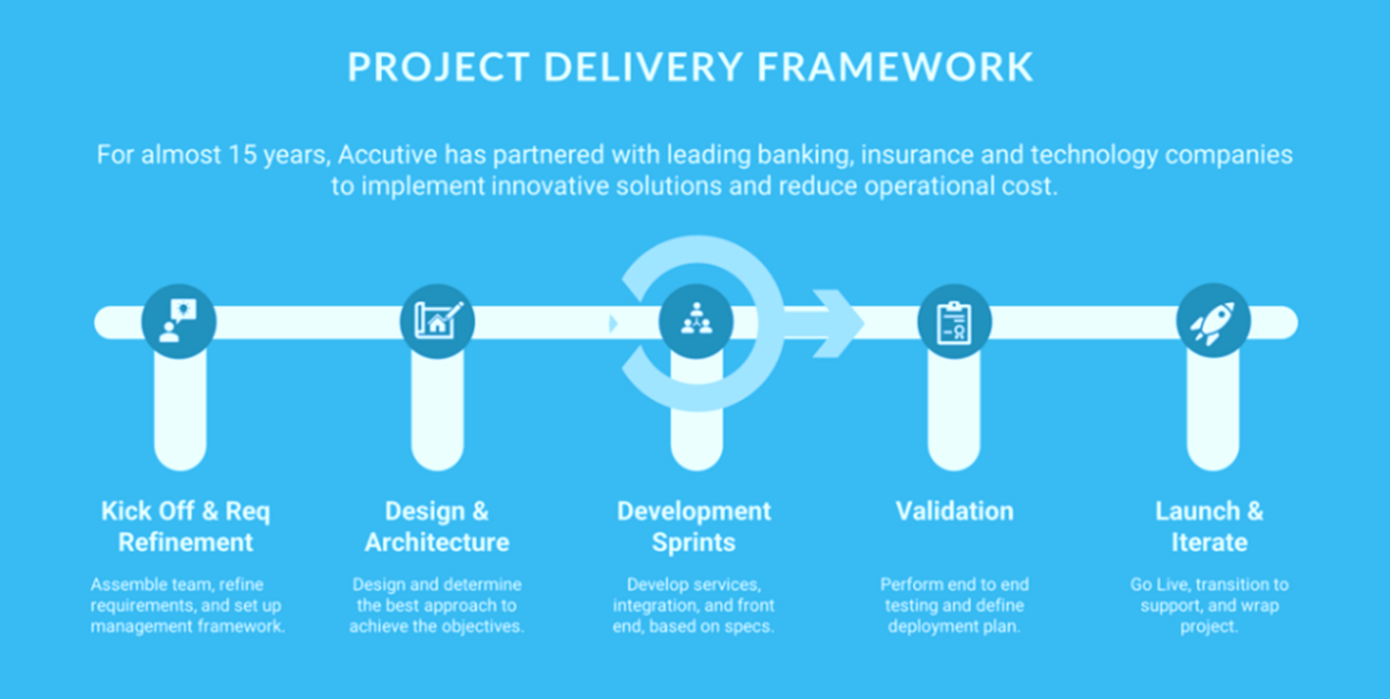

Accutive FinTech, a top Temenos Certified Partner for the Journey Manager platform, worked with the bank to understand their requirements and developed a comprehensive plan to implement Temenos Journey Manager. Temenos Journey Manager is intended to enhance the bank’s new customer acquisition and create an exceptional customer experience from Day 1.

The Challenge

This digital banking transformation project involved collaboration between Accutive FinTech and seven other teams – five internal client teams and two other vendors. Due to the coordinated nature of this program, any Temenos Journey Manager implementation quality issues, including defects, would impact the other teams’ work as well.

Our Accutive FinTech team of certified Journey Manager experts drew upon their extensive experience coordinating with multiple teams to establish open channels of communication and regular touchpoints. Critically, our experts analyzed the requirements and project environment from the perspective of all parties. This analysis informed the project plan and helped ensure all delivery deadlines were realistic, fixed, attainable, and aligned with the client’s deployment process.

A Quality First Approach to Implementation

The project management triangle, or triple constraint, states that the competing constraints of scope, budget, and schedule must balance or quality will suffer. To ensure on time, on budget delivery our Accutive FinTech team’s goal is to deliver consistent high quality code that provides clients with the confidence to accelerate their testing timelines and deploy earlier.

In addition to leveraging the Temenos Implementation Methodology, every Accutive FinTech project is delivered with our Quality First Approach. The Accutive FinTech Quality First Approach is based on three key pillars: high-QA-to-developer ratio, early detailed requirements analysis, and our zero defect mentality.

High QA-to-Developer Ratio

During the project planning phase, Accutive FinTech staffed the project with a higher ratio of quality assurance (QA) resources than is typical. A greater focus on QA throughout the project enables greater test coverage for bug identification and correction much earlier in the process. Before the Temenos Journey Manager development work began, Accutive collaborated with the client to develop a testing and rollout strategy that is responsive to the client’s timelines.

In addition to reducing project risk, our high QA-to-developer ratio facilitates consistently on-time delivery with lower-than-average defect rates. Iterative defect identification and remediation began after the first sprint with both Accutive and client testing.

Early Detailed Requirements Analysis

Ensuring that clients and implementation partners have a consistent understanding of the requirements is critical for ensuring that the project meets the business needs. Accutive FinTech began the Journey Manager project with a detailed requirements gathering and analysis process. This process helps ensure that all resources on both the Accutive FinTech and client side have a clear, consistent understanding of the requirements.

Following the requirements analysis, we worked with the client to develop realistic development and testing plans. As a result of the detailed requirement analysis, we were able to complete the project on time with zero change requests.

Zero Defect Mentality

While many system integrators accept defects as an inevitable part of every project, Accutive FinTech strives to minimize defects in every project. We establish an action plan to prevent defects in every Journey Manager project, including regular audits and testing before code is delivered to the client.

Although zero defects is not always achievable, Accutive FinTech uses a continuous improvement system and lessons learned feedback program to ensure that each defect is a learning opportunity for the team.

Client Outcomes

Encouraged by the low defect rate, the client began operational testing two weeks ahead of schedule. This accelerated testing timeline presents an opportunity for our client to compress their overall test schedule. With the application of the Quality First Approach, the Temenos Journey Manager project was delivered with only 20 failed test cases out of a total of 737. The overall defect rate was 2.7%, which is significantly lower than the typical rate for digital account opening implementation projects.

Moreover, with 0 post-production defects the financial institution was able to provide seamless, error-free onboarding experience to their customers. This resulted in significantly lower abandonment rates, and higher account opening satisfaction as measured by CSAT surveys.