APIs are the link that enables communication between different applications across your entire digital ecosystem. The importance of APIs has

- Home

- FinTech Solutions

Most Recent Insights

Overview of MuleSoft Anypoint Code Builder (ACB) What is MuleSoft Anypoint Code Builder (ACB)? Anypoint Code Builder is a cutting-edge

A seamless, reliable and straightforward customer onboarding experience is no longer a ‘nice to have’, it is essential for your

Open banking is expected to introduce new competition in the financial services industry and open the door to significant growth

When it comes to training for MuleSoft or other iPaaS (Integration Platform as a Service) alternatives, there is no one

4/23/24 Update: Salesforce has reportedly pulled out of the Informatica acquisition talks due to Informatica’s lack of interest in a

- Services

Explore Our Recent Case Studies

Learn how Accutive FinTech integrated a new digital payments platform with the core banking system and other applications using MuleSoft with zero defects

Explore Accutive FinTech's case study on seamless loan origination system integration, boasting an impressive 0.5% defect rate, surpassing industry norms.

Read how Accutive's quality obsessed approach is producing remarkably low defects in our latest Temenos Journey Manager project for a large regional bank.

- FinTech Insights

FinTech Insight Category

Case Studies

Whitepapers

Solution Briefs

Articles

- About Accutive

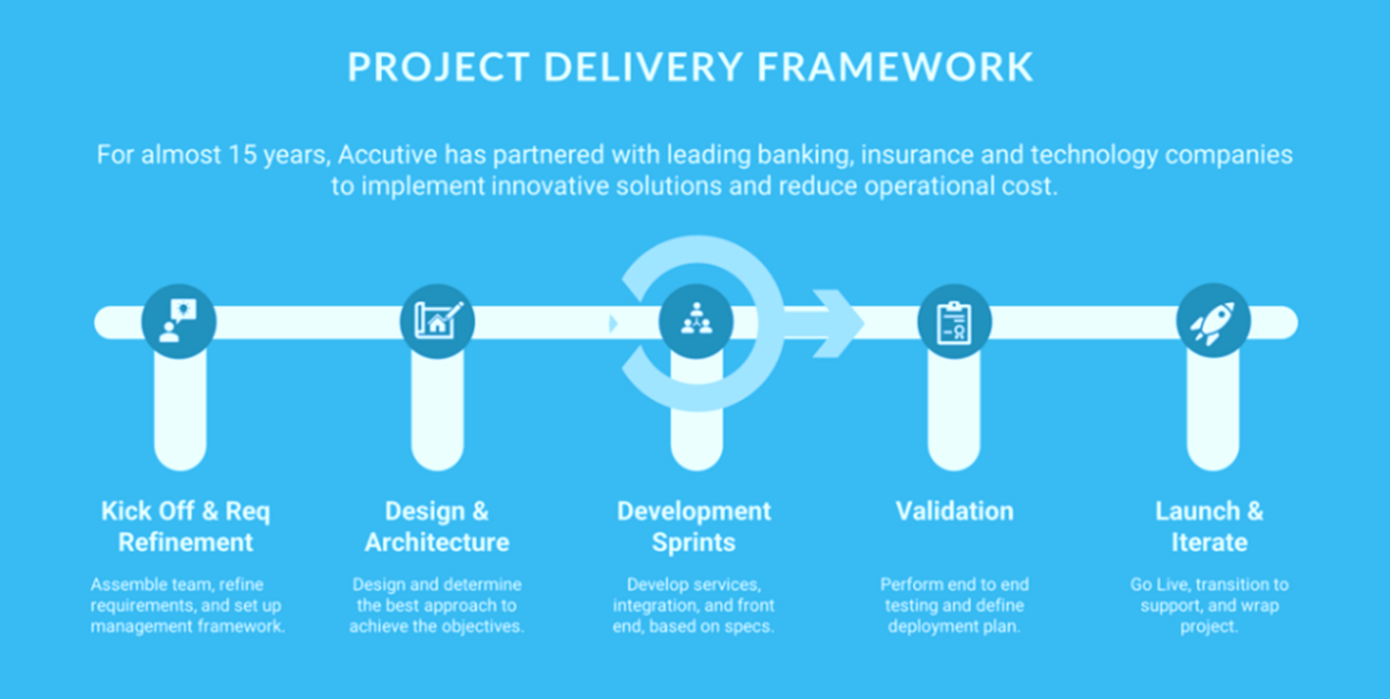

Accutive FinTech extends your team with experts who apply our Quality First Approach to deliver your digital transformation projects on time, on budget, and with low defects.

Accutive FinTech extends your team with experts who apply our Quality First Approach to deliver your digital transformation projects on time, on budget, and with low defects.

- Let’s Talk