In the swiftly changing landscape of financial services, technological agility is a necessity. Although cloud upgrades are easier, upgrading your iPaaS can still be daunting. Despite this, keeping your MuleSoft Anypoint platform updated is vital for security, innovation, and operational excellence.

Here are our top 5 benefits of staying up to date with MuleSoft for banks and credit unions:

- Staying Secure: The threat landscape continues to evolve (or devolve, depending on your perspective) and financial institutions continue to be a top target. Leveraging MuleSoft’s built-in security features through regular attention to throttling, logging, monitoring, and API governance is critical. Beyond this, upgrading empowers you to capitalize on the latest security patches and enhancements

- Critical Compliance: MuleSoft has out of the box compliance with major compliance standards such as ISO 27001, SOC 1, SOC 2, PCI DSS, and HIPAA; however, taking advantage of this requires stay up to date.

- Capitalizing on new innovative features: Salesforce has been continually rolling out exciting new features and functionality across its entire ecosystem, including MuleSoft. Perhaps the most impactful developments for banks and credit unions are the ongoing enhancements to MuleSoft Accelerator for Financial Services Cloud, which continues to unlock exciting new capabilities.

- Optimal Performance and Reliability: Keeping your iPaaS updated is vital – since your integration platform connects many different systems, your entire FinTech framework is dependent upon its reliability. The best way to keep your system operating smoothly with minimal downtime is to stay up to date.

- Maximizing Scalability + Flexibility: One of MuleSoft’s key advantages compared with other iPaaS platforms (such as Boomi) and direct integrations, is its scalability and flexibility. Your MuleSoft Anypoint Platform can seamlessly grow alongside your financial institution, and help you stay agile through automation and reusability. An important prerequisite for ongoing scalability and flexibility having the latest version of MuleSoft implemented in a timely fashion.

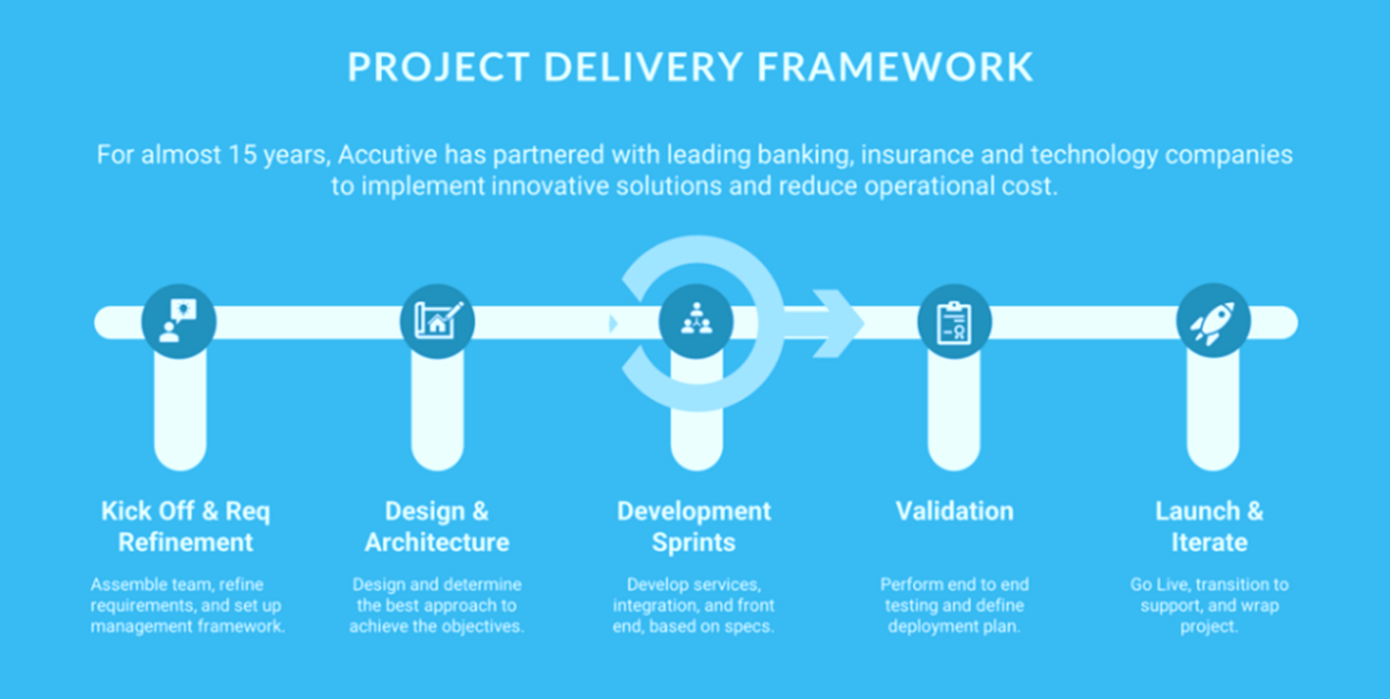

Accutive Fintech: Your MuleSoft PartnerLeverage Accutive Fintech’s expertise to maximize your MuleSoft investment. Our certified MuleSoft specialists will provide you with the insights and support you need to navigate the complexities of the financial services technology landscape, ensuring your systems are not only current but fully optimized.