MuleSoft API Security: Best Practices for Secure Governance

Your financial institution’s increasingly complex systems require a secure and seamless integration solution. Salesforce’s MuleSoft Anypoint Platform is the leading integration platform in the financial services industry and the one that we recommend most often to our clients. There are many reasons why we recommend MuleSoft, with its security capabilities being one of the primary ones. MuleSoft has built-in security capabilities and it is certified under major compliance frameworks including GDPR, PCI, and ISO 2700. When these built-in features are properly configured and combined with advanced, multi-layer protection, your data and APIs are well protected.

MuleSoft’s built-in security is a double-edged sword – one issue we encounter is new clients assuming they don’t need to worry too much about security configuration, API governance, or additional security measures because of MuleSoft’s out-of-the-box security features. Unfortunately, these baseline functions are insufficient in industries with sensitive data, such as the financial services industry.

Best Practices for Securing Your MuleSoft Anypoint Platform

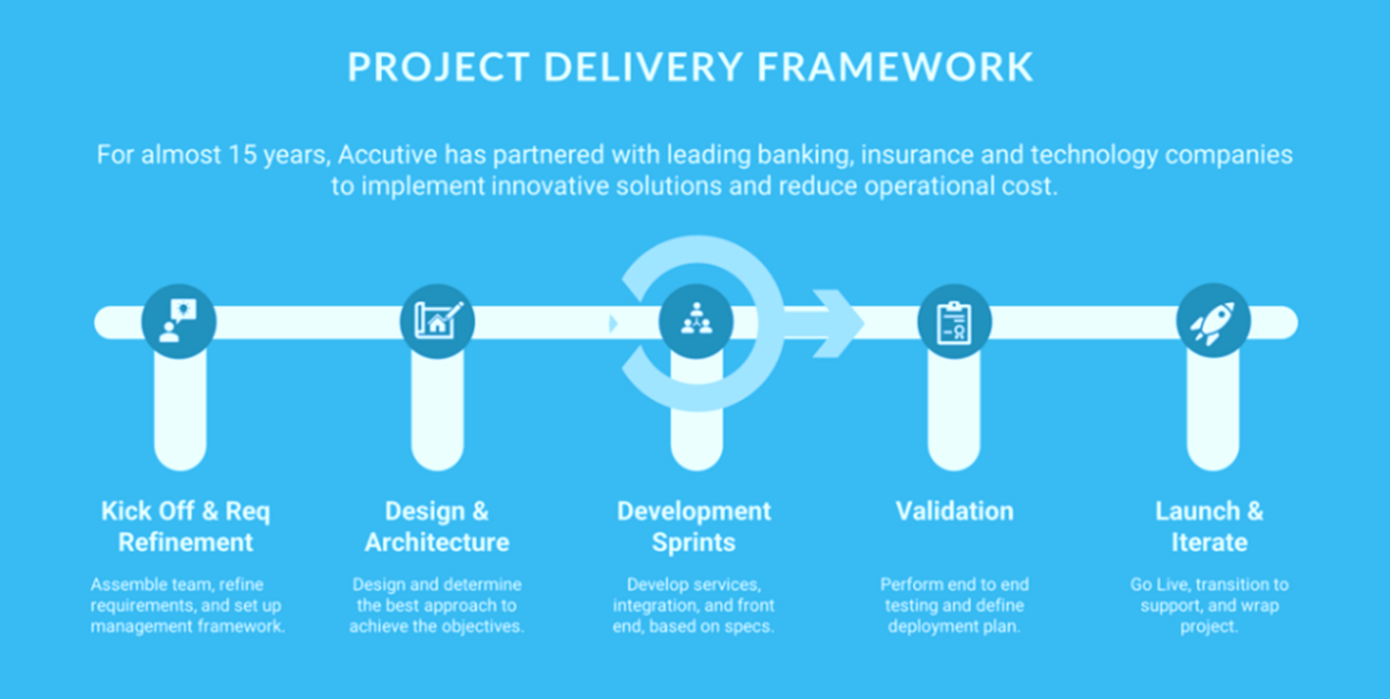

Accutive FinTech + Security brings 15 years of combined experience in financial technologies and cybersecurity with a particular focus on secure integration solutions. Based on our extensive project experience, we have developed a comprehensive set of MuleSoft best practices that form the basis for our robust MuleSoft practice reviews. A key component of our best practices framework is API governance and security. To get started, here are 4 areas to look at when evaluating the security of your Anypoint platform:

1. Your logging practices: Logging in MuleSoft is a critical, albeit often overlooked aspect of an effective and secure Anypoint Platform. Logging has many benefits, including:

- Demonstrating compliance by tracking how regulated data was accessed and used

- Creating audit trails, which are critical for security and compliance investigations

- Error identification and debugging

2. Your Data Encryption Setup: Your data needs to be secured both in transit and at rest. For data in transit, the first step is setting up Transport Layer Security (TLS/SSL) in your Anypoint Platform. We recommend robust end-to-end encryption to protect your data across all your platforms. For bolstered security, integrating your Mule ESB with a Hardware Security Module (HSM), such as Thales Luna 7 HSM, provides an extra layer of physical protection.

3. Your vulnerability to DDoS and other attacks: A key component of protecting your MuleSoft platform is ensuring that you have mechanisms in place to prevent volume-driven cyberattacks, such as distributed denial of service (DDoS) attacks. Properly configuring your throttling and rate limit protections in your Anypoint Platform reduces your risk.

4. Your Identity and Access Management (IAM) framework: It is essential to ensure that only approved, authenticated human and machine identities can access the critical data that flows through your Anypoint Platform. When evaluating IAM frameworks for MuleSoft we draw on the expertise of our cybersecurity arm, Accutive Security, which is a center of excellence in IAM and Cryptography. Navigating the IAM and authentication landscape can be daunting, and it is often challenging to build the right framework without subject matter expertise.

A Multi-Layered Approach to Securing Your Data and APIs

At Accutive FinTech, we work with our clients on an integrated approach to API security by combining MuleSoft’s inherent capabilities with additional layers of protection. Although these four critical areas provide a starting point for enhancing your API security, there are numerous other critical security considerations. For financial institutions, Accutive FinTech offers complimentary 40-hour MuleSoft Practice Reviews where we highlight additional areas for improvement, and to flag any security vulnerabilities you may have. Learn more about our MuleSoft services or email letstalk@accutive.com to get started toda