MuleSoft for Financial Services: 2023 Year in Review

Although 2023 was a turbulent year for banks and credit unions, there were numerous exciting innovations in the FinTech landscape – and integration platforms like MuleSoft are key enablers of many of these new technologies.

MuleSoft Accelerator for Financial Services: Bridging Data and Engagement

MuleSoft’s release of its Accelerator for Financial Services was a game changer for banks and credit unions, and it keeps getting better with each release. The latest version integrates Thought Machine’s Vault Core, offering a comprehensive view of financial account data. This integration streamlines the connection between critical financial data and Salesforce Financial Services Cloud, elevating customer engagement to new heights. Earlier in the year, MuleSoft enhanced its Salesforce integration, further unifying customer data across various Salesforce platforms.

Enabling Rapid, Secure Connections

MuleSoft’s focus on creating secure, fast financial services experiences is evident. Their platform now allows for the rapid connection of systems and unlocking of data with out-of-the-box connectors and integration templates. This approach not only speeds up digital transformation but also empowers teams to innovate at scale, delivering connected customer experiences like never before.

The Indispensable Role of APIs in FinTech

APIs have become the backbone of FinTech innovation. MuleSoft’s strategy emphasizes the critical role of APIs in financial services, enabling firms to manage vast data, streamline operations, and offer a unified view of customers, employees, and partners. This approach fosters connectivity and innovation, allowing financial institutions to adapt to the evolving demands of the digital era.

MuleSoft Direct for Financial Services Cloud

A standout development is MuleSoft Direct for Financial Services Cloud, which simplifies the integration of Salesforce with key industry systems. This solution provides pre-built integrations that align with industry standards and Salesforce’s data model. It’s a testament to MuleSoft’s commitment to accelerating digital transformation in financial services, ensuring quicker deployment and value realization.

Looking Forward to 2024

As we look forward to 2024, we predict MuleSoft advancements in three key areas:

- Further AI-enabled automation: We expect MuleSoft to leverage generative AI technologies to predict and automate API creation and flow design, as well as enable advanced predictive analytics.

- Cloud and Edge computing: As cloud and edge computing continue to evolve, we anticipate more robust MuleSoft solutions for microservices, containerization, serverless computing, and IoT integrations. This would cater to the growing demand for faster, more decentralized data processing and decision-making in various business environments.

- Strengthening the Salesforce ecosystem: Over 2023, we have seen Salesforce make strides in enhancing MuleSoft’s integrations with Salesforce, in particular Salesforce for Financial Services Cloud. We expect Salesforce to continue with this strategy in 2024, creating a more seamless ecosystem for clients.

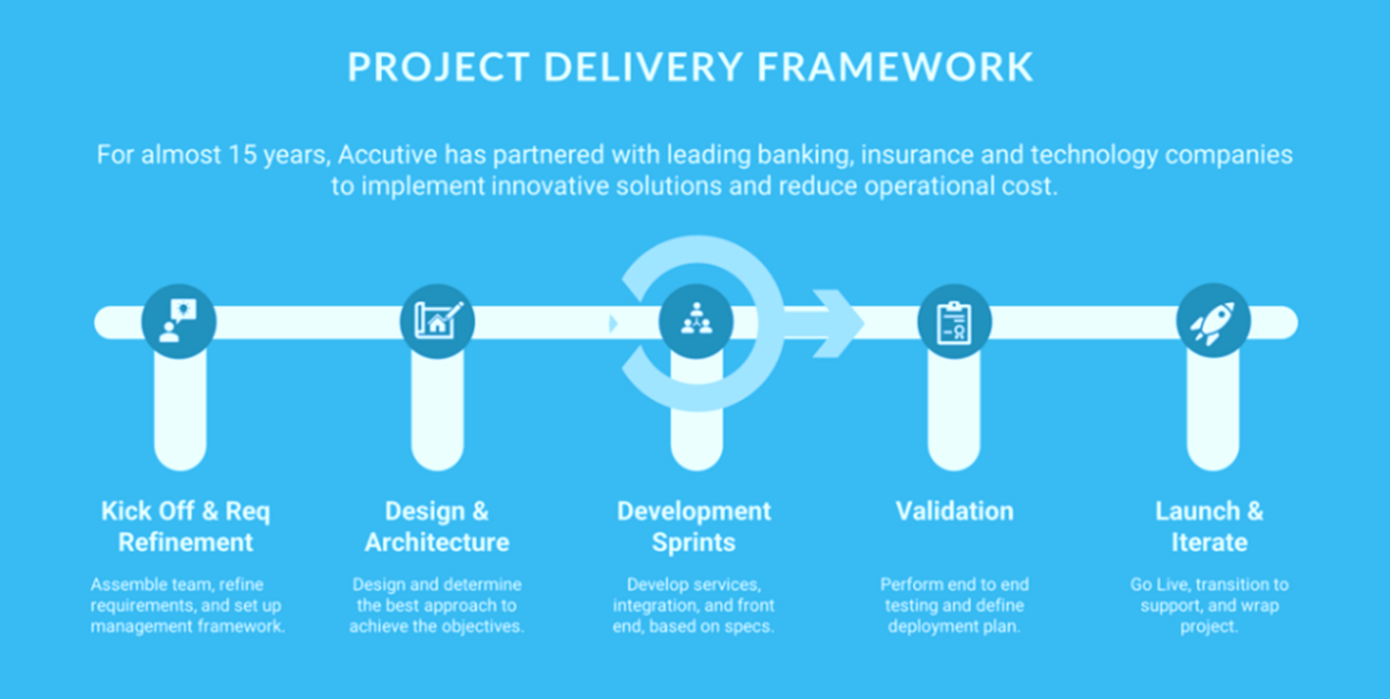

Get your 2024 off to a great start and futureproof your organization by maximizing your MuleSoft investment, and capitalizing on its new and advanced features and capabilities. With Accutive FinTech’s MuleSoft Practice Reviews, our certified experts will provide you with a comprehensive roadmap to elevate and secure your Anypoint Platform.

Here’s to 2024, and the exciting innovations it will bring!